The legal transcription industry in the United States is undergoing a massive transformation. Fueled by technological advancements in the courtroom, the rising number of legal cases, and an increasing need to fill in the void being left by a decreasing number of court reporters, the industry is on an impressive growth trajectory. Here are the projections for the market size growth, key user segments, and procurement trends shaping the future of legal transcription.

Legal Transcription Market Overview: A Billion-Dollar Opportunity

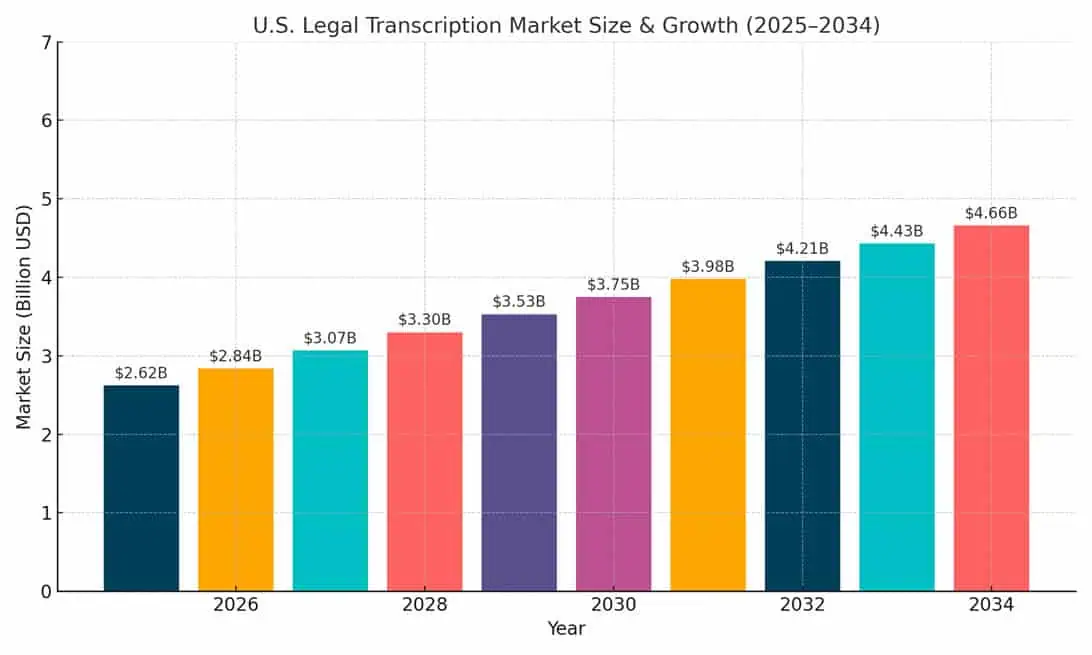

The U.S. legal transcription market is valued at $2.62 billion in 2025 and is forecasted to reach $4.66 billion by 2034, growing at a CAGR of 6.9% over the next decade (Market Research Future, 2024). The overall transcription market is currently valued at $3.01 billion in 2024 and is forecasted to nearly triple, reaching $9.51 billion by 2034.

Table: U.S. Legal Transcription Market Size (2025-2034)

What’s Fueling This Growth?

Several key forces are propelling the growth of the U.S. legal transcription market in 2025 and beyond:

1. Technological Advancements

Almost every single courtroom in the US now has high end audio visual recording capabilities, which allows for cases to be heard without a court reporter present. As court transcription work increasingly moves to remote options when needed, secure cloud based transcription services companies are becoming essential. These services allow secure, real-time access to case files and documentation from anywhere in the US, supporting faster streamlined workflows and collaboration.

2. Regulatory & Compliance Pressure

Law firms and courts face growing pressure to maintain accurate and compliant records of legal proceedings. This demand has heightened the reliance on legal transcription services companies to produce timely, legally defensible documentation, especially for depositions, hearings, and trials.

3. Court Reporter Shortages

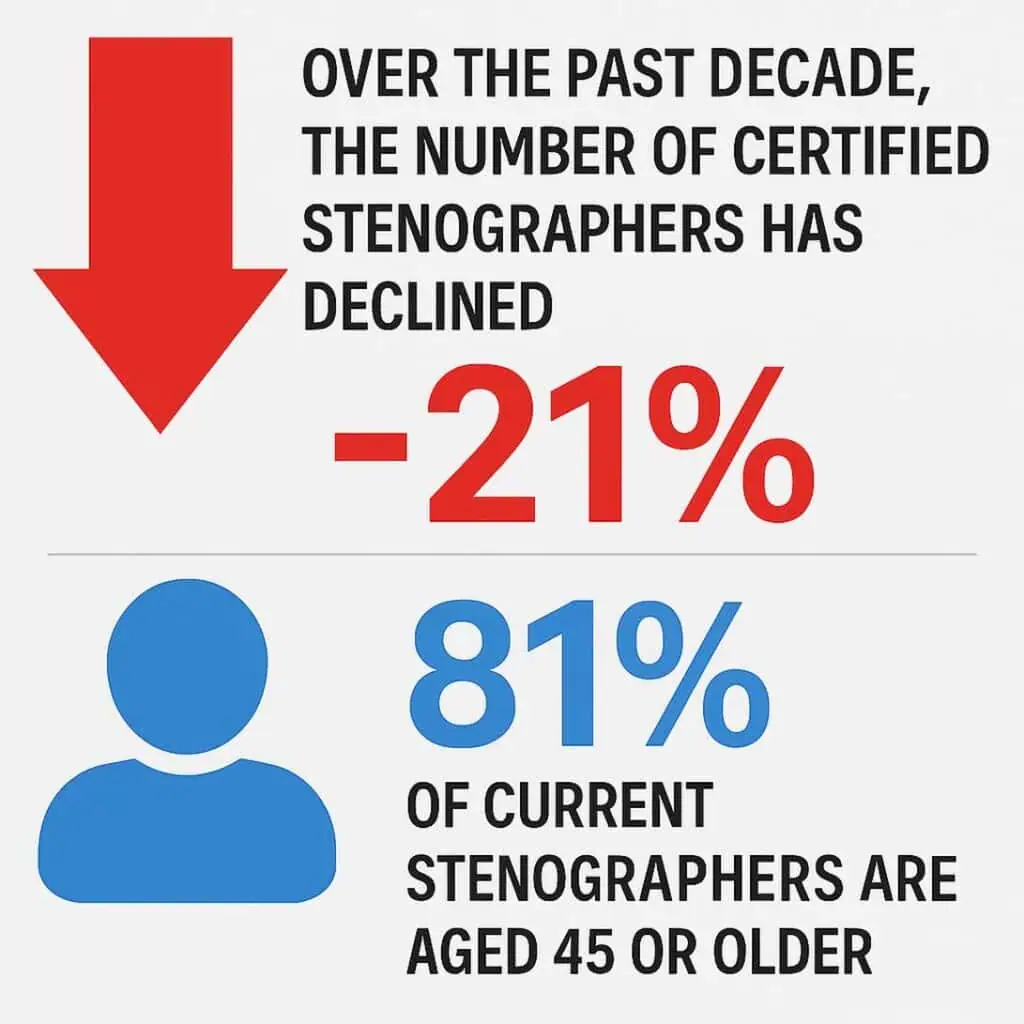

A significant driver of transcription demand is the widening gap in the court reporter workforce. The U.S. is facing a retirement wave among certified stenographers and insufficient new entrants to fill the void:

- The number of certified stenographers has declined by 21% over the past decade.

- 81% of current stenographers are aged 45 or older, signaling an impending generational exit.

In California alone, the judiciary is short more than 450+ full-time court reporters, directly impacting the ability to maintain timely court records and causing delays in some proceedings (California Judicial Branch).

This shortage is creating systemic pressure and accelerating the shift toward digital legal transcription services as a scalable and reliable alternative.

Who’s Using Legal Transcription Services?

1. Law Firms

Make up the largest segment. They use transcription for depositions, court hearings, briefs, client meetings, and more. The demand is high for services that ensure precision and legal compliance.

2. Court Systems

Rely on legal transcription services companies to create certified verbatim records of trials, hearings, and depositions.

3. Government Agencies

Utilize transcription for legislative sessions, policy reviews, and administrative hearings of all kinds.

4. Corporations

Require transcription for some HR meetings, claim interviews, and recorded statements. Especially important for publicly traded companies and fraud investigations.

5. General Public

The general public has started to use verbatim transcription services companies because they are looking for faster and cheaper services outside of what is traditionally offered by court reporting companies.

Procurement Trends Shaping 2025

1. Shift Toward Pay-As-You-Go Models

Instead of long-term multi year contracts, many legal organizations are opting for pay-as-you-go transcription services. This model offers flexibility, especially for smaller firms or agencies with fluctuating caseloads. It allows users to scale up or down as needed without being locked into contracts.

2. Security and Compliance-First Transcription

Procurement decisions are increasingly driven by strict compliance requirements. Services must be CJIS-compliant (Criminal Justice Information Services), ensuring that all data handling, storage, and processing adhere to the FBI’s rigorous standards. This includes:

- U.S.-based data centers and transcriptionists

- No foreign access to any data

- CJIS security training for all personnel, including fingerprint background checks

Most government and private organizations are now explicitly excluding foreign-based transcription companies or freelancers from consideration due to these critical compliance factors.

3. Integrated Ecosystems and On-Demand and 24/7 Services

Legal teams are choosing vendors that integrate with their existing case management systems (e.g., Clio, MyCase).

The shift toward online based legal support means procurement now favors legal transcription services companies that offer 24/7 secure access and quick turnaround times.

The Key Takeaway: Court Reporting Has a Massive Shortage

The U.S. legal system is facing a critical talent gap in court reporting. Demand for accurate, real-time legal documentation continues to rise, yet the available workforce of certified stenographers is shrinking. This is not a temporary challenge, it’s become a systemic shortage that is worsening over time.

Several important factors are driving this shortage:

- An Aging Workforce: A substantial portion of certified court reporters are nearing retirement, with fewer new entrants replacing them.

- Collapse of Education Pipelines: Court reporting schools are disappearing across the country. The industry has experienced a staggering 42% decline in training programs, leaving fewer pathways into the profession. Once considered the premier court reporting teaching institution, Brown College of Court Reporting, has shuttered due to insufficient enrollment.

- Enrollment Declines: Interest in stenography as a career has declined for two reasons. The rigorous nature of training, often two years or more, and a state certification pass rate below 10% are discouraging many prospective students.

- Faster Alternatives: In contrast, digital court reporting and legal transcription training can be completed in as little as a few months, offering a more accessible route into the field.

This compounding shortage is no longer a hiring issue; it’s a legal nightmare operations backlog. Without enough stenographers to meet growing court case volumes, case timelines are becoming much longer, appeal windows narrower, and the risk of documentation gaps increases.

The New Strategic Role of Legal Transcription Services

Given these structural constraints, legal transcription service providers offer a legitimate, scalable solution. These companies, like Ditto Transcripts, employ highly trained legal transcription professionals. They increasingly leveraged a remote business model to deliver accurate, secure, and timely transcripts.

Is it time for legal institutions, court systems, and law firms to more seriously consider legal transcription services as part of their workflow options? Not as a workaround, but as a core capability for meeting legal documentation needs in the decades ahead. I think we all know the answer to that now. We’ve been asked by clients in all 50 states now to help with a court case that has either been delayed because they couldn’t get a transcript in time, or because the client was seeking a cheaper alternative to a court reporting company’s high costs.

Ditto Transcripts is a Denver, Colorado-based, HIPAA, FINRA, & CJIS-compliant transcription services company that provides fast, accurate, and affordable transcripts for individuals and companies of all sizes. Call (720) 287-3710 today for a free quote, and ask about our free five-day trial.