In an era where transparency, accountability, and precision in legal proceedings are under sharper scrutiny, human transcription services remain the gold standard for law enforcement agencies across the U.S. Whether it is recorded interviews, body camera footage, 911 calls, or undercover operations, the demand for accurate, secure, and court ready transcripts has never been stronger. In fact, by 2025, law enforcement agencies nationwide will generate over 10 million hours of audio and video footage annually, creating unprecedented demand for law enforcement transcription services.

As agencies grapple with this surge in recorded data, their reliance on certified, CJIS compliant human transcriptionists trusted to preserve confidentiality and evidentiary integrity continues to rise. Strict regulatory frameworks, evolving court standards, and growing public expectations around transparency compel law enforcement to seek providers who can consistently deliver rapid turnaround, 99% accuracy, and documented chain of custody. Unlike automated alternatives, US based human transcriptionists possess the contextual awareness, domain expertise, and the nuanced ability to handle multiple speakers, diverse accents, and specialized law enforcement terminology and acronyms. Without these qualities the transcripts aren’t usable for legal admissibility and investigative uses.

This report takes a comprehensive look at the current U.S. market in 2025, exploring its size, growth trajectory, and key segments before projecting a decade long forecast through 2035. We will show the primary market drivers, dissect what agencies expect from their transcription partners, and map out the strategic challenges and opportunities ahead. Packed with year over year figures, visual insights, and a forward looking perspective, this article gives decision makers the knowledge needed to navigate and thrive in the evolving law enforcement transcription landscape.

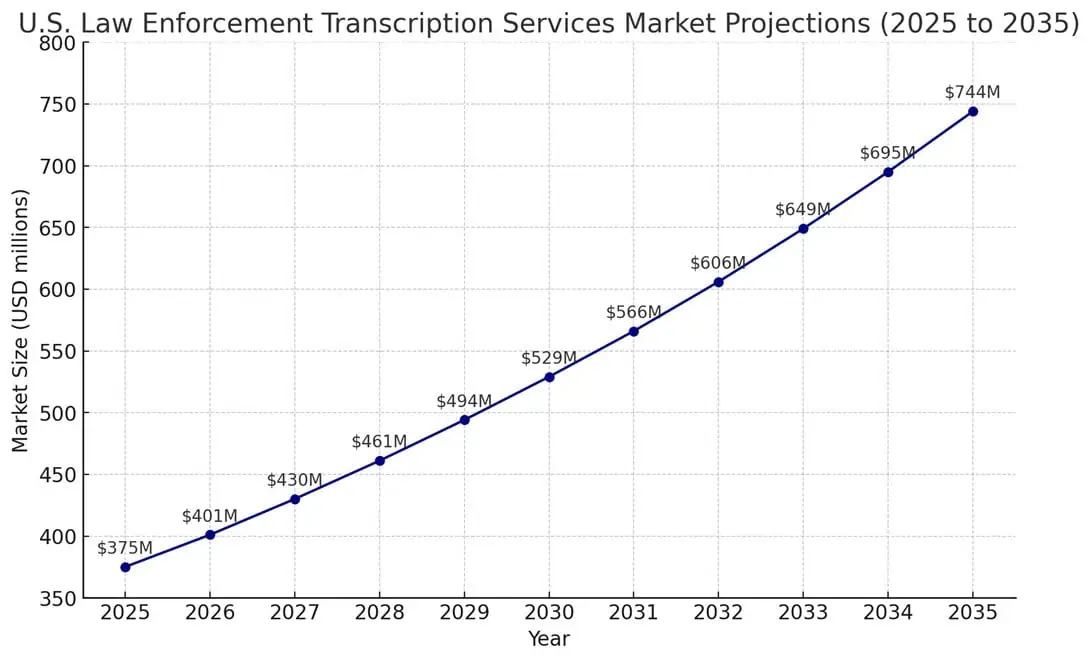

Law Enforcement Transcription Market Size (USD Millions)

As of 2025, the market for law enforcement transcription services in the United States is estimated at approximately $375 million. This valuation accounts specifically for human generated transcription services and excludes any automated or technology based transcription methods. The estimate is derived from current spending patterns, budget allocations from law enforcement agencies nationwide, and growth observed over the past five years.

Key Segments and Usage Patterns

Law enforcement transcription services are primarily utilized by three major types of agencies:

Police Departments

Police departments represent the largest user segment. They primarily require transcription for recorded witness interviews, suspect interviews, wiretaps, undercover wires, and 911 calls. These departments prioritize accuracy and certified transcripts due to their direct impact on criminal investigations and court proceedings. As of 2025, police departments account for approximately 60% of total market usage.

Sheriff’s Offices

Sheriff’s offices represent another significant segment, primarily using transcription for recorded jail calls, inmate communications, internal investigative interviews, and surveillance recordings. These transcripts often become evidence in both criminal investigations and court proceedings. Sheriff’s offices account for approximately 25% of the market usage in 2025.

Federal Law Enforcement Agencies

Federal agencies, including the FBI, DEA, and ATF, utilize transcription services extensively for investigative interviews, wiretap recordings, and undercover operation recordings. Given the complex nature of federal investigations and stringent evidentiary standards, federal agencies rely exclusively on human transcriptionists with appropriate security clearances and CJIS compliance. Federal agencies account for approximately 15% of the overall market in 2025.

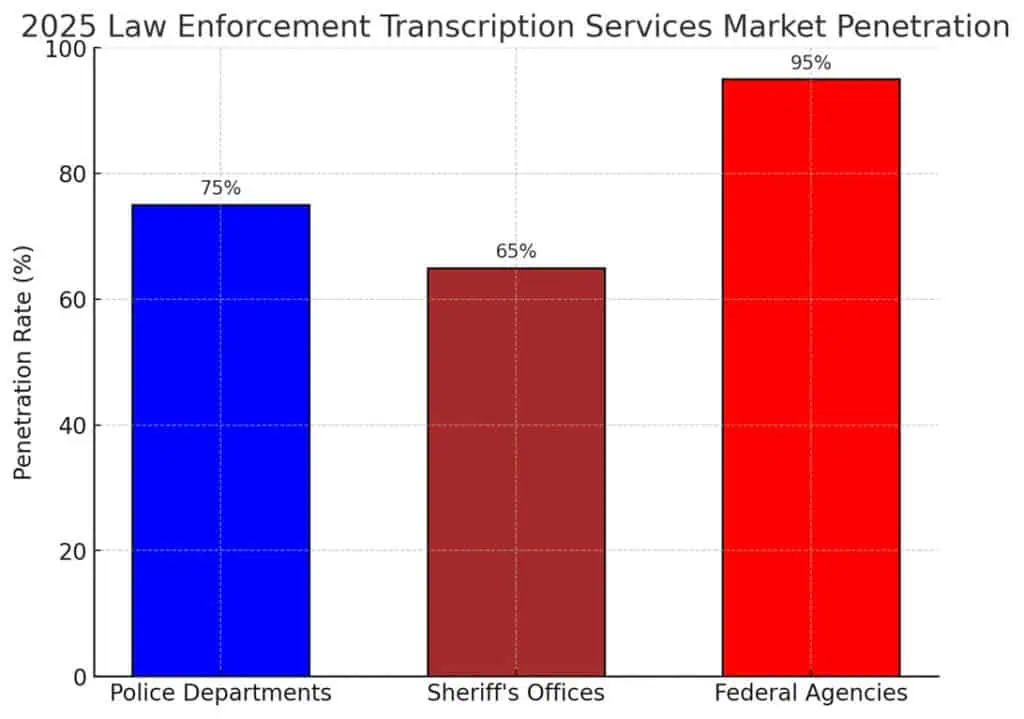

Number of Agencies Currently Utilizing Transcription Services

In 2025, around 75% of all U.S. police departments are actively utilizing professional human transcription services. For sheriff’s offices, this number stands around 65%, reflecting slightly lower adoption due to varying local budget constraints. Federal law enforcement agencies show nearly universal adoption, with approximately 95% of federal agencies utilizing human based transcription services regularly.

Law Enforcement Transcription Market Growth Overview

The human transcription services market for law enforcement agencies in the United States is expected to experience steady and consistent growth from 2025 through 2035. The annual growth rate will average approximately 7 percent, driven by increasing regulatory requirements, rising volumes of recorded investigative materials, and ongoing commitments to accuracy and security.

The following graph shows the detailed annual market size projections and corresponding annual growth rates for this period:

Observations and Analysis

The data indicates a steady, predictable trajectory over the next decade. Starting at $375 million in 2025, the market is projected to nearly double, reaching $744 million by 2035. Annual increases remain consistent, reflecting ongoing demand from law enforcement agencies and consistent budget allocations for secure and accurate transcription services.

The slight fluctuations in annual growth rates between 7 percent and 7.3 percent reflect anticipated variations in state and federal funding, agency adoption rates, and incremental regulatory developments.

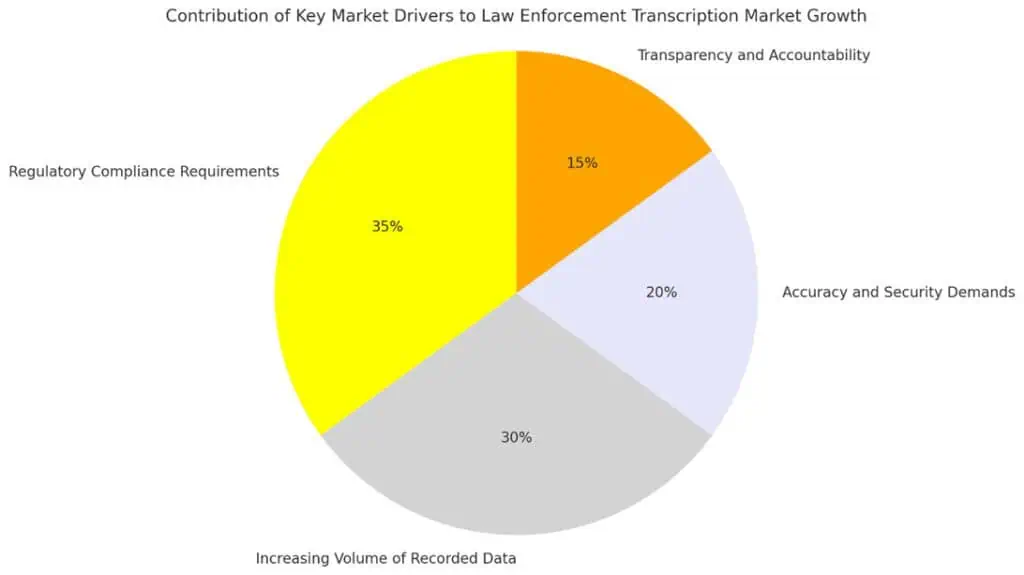

Key Market Drivers for Law Enforcement Transcription Services

Several factors drive consistent growth within the law enforcement transcription services market. These include regulatory compliance, the increasing volume of recorded material, accuracy and security demands, and the public’s expectations around transparency.

Regulatory Compliance Requirements

Compliance with Criminal Justice Information Services (CJIS) standards significantly influences the demand for transcription services. Law enforcement agencies require strict adherence to security guidelines, confidentiality, and criminal background checks for transcription providers. Approximately 35 percent of the overall market growth is attributed directly to compliance requirements, reflecting the critical role these standards play in procurement decisions.

Additionally, transcripts used in court proceedings must meet strict admissibility standards. Courts increasingly require professionally produced, certified transcripts, making human transcription necessary due to its reliability and accuracy.

Increasing Volume of Recorded Data

Law enforcement agencies continually generate large amounts of audio and video data. Sources include body camera footage, jail calls, 911 calls, and interview recordings. The consistent rise in recorded material accounts for approximately 30 percent of the growth in demand for law enforcement transcription services. Agencies rely heavily on human transcriptionists capable of managing lengthy and complex audio recordings accurately.

Focus on Accuracy and Security

Agencies prioritize accuracy and security above other factors. Transcriptions must be error free and maintain the integrity of recorded evidence, which allows their acceptance in legal proceedings. This emphasis on quality and certified accuracy contributes approximately 20 percent to market growth, underscoring the importance agencies place on reliability and the human element in transcription processes.

Shift Towards Transparency and Accountability

Public records laws and transparency initiatives require law enforcement to provide documented evidence and records upon request. This trend toward greater openness and public oversight accounts for approximately 15 percent of the overall market growth. Agencies increasingly choose professional human transcription services to ensure public records are clear, accessible, and accurate.

Law Enforcement Agency Expectations and Demands

Law enforcement agencies have clearly defined expectations when selecting transcription service providers. Agencies prioritize specific service qualities and face several operational challenges in managing recorded material and transcripts.

Priority of Service Qualities

Law enforcement agencies emphasize the following core service qualities:

- Speed and Turnaround Time

Agencies require prompt transcription delivery. Most expect turnaround times of less than 48 hours for routine cases, with urgent matters demanding delivery in under 24 hours. - Confidentiality and Security (CJIS Compliance)

Agencies must ensure strict adherence to Criminal Justice Information Services standards. Transcription providers are required to implement rigorous security measures to protect sensitive information and maintain CJIS compliance. - Certified Accuracy and Court Readiness

Transcripts must meet high accuracy standards due to their direct use in court. Certification of accuracy ensures transcripts will withstand scrutiny during judicial proceedings. - United States Based Transcriptionists with Criminal Background Checks

Agencies mandate transcriptionists be located in the United States and have passed criminal background checks, guaranteeing data security and maintaining regulatory compliance.

Challenges Faced by Agencies

Law enforcement agencies face operational challenges related to the handling and processing of audio and video data:

- Backlogs of Unprocessed Audio and Video

Agencies frequently experience backlogs due to significant volumes of recorded material, including body camera footage, jail calls, and investigative recordings. These backlogs can delay investigations and prosecutions. - Increasing Scrutiny on Evidentiary Standards and Transcription Accuracy

Courts and defense attorneys are more frequently scrutinizing transcripts, demanding high standards of accuracy. Errors or inaccuracies can compromise investigations, prosecutions, and overall credibility.

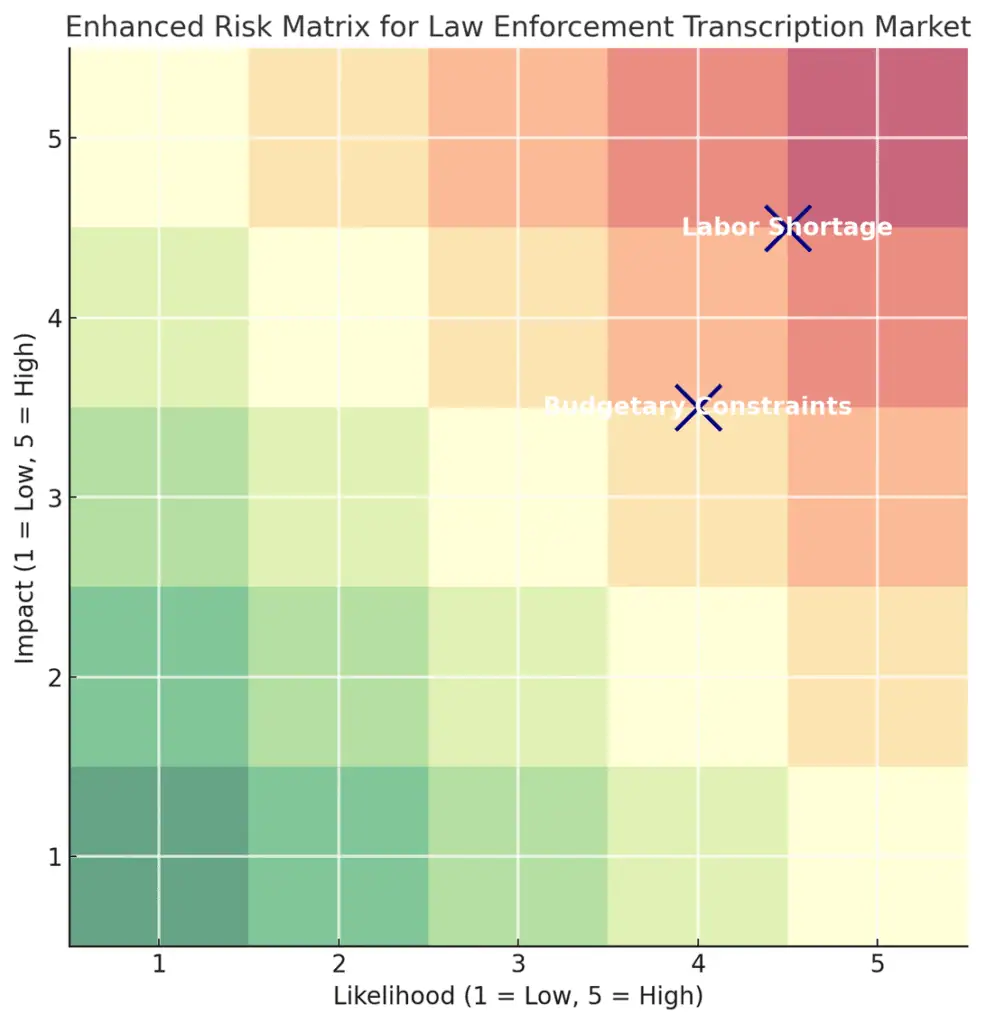

Risks and Challenges to The Law Enforcement Transcription Services Market

Law enforcement agencies and transcription service providers face several significant risks and challenges that could impact the growth and stability of the law enforcement transcription market.

Budgetary Constraints and Fiscal Pressures

Law enforcement budgets across the United States frequently experience constraints due to competing priorities and fluctuating local, state, and federal funding. Agencies must allocate funds carefully, balancing transcription needs with other critical expenses such as staffing, training, technology upgrades, and operational costs.

Fiscal pressures have resulted in increased scrutiny of expenditures on transcription services, making it essential for agencies to demonstrate clear value in these investments. Budget limitations have caused some departments to reduce spending on external transcription providers, potentially affecting both the quality and timeliness of transcripts. The likelihood of this challenge significantly influencing market dynamics is considered high, with potential impact categorized as moderate to high, depending on local budget conditions.

Labor Shortage of Qualified, Security Cleared Transcriptionists

A notable challenge facing the transcription market is the limited pool of qualified transcriptionists who have successfully passed criminal background checks and obtained required security clearances. The specialized nature of law enforcement transcription requires transcriptionists who possess both advanced skills and compliance with stringent CJIS standards.

The ongoing labor shortage may delay transcription turnaround times and hinder the ability of transcription companies to meet the growing demand from law enforcement agencies. As demand steadily increases, recruiting and retaining good transcriptionists who meet strict compliance and skill requirements will become progressively more difficult. The likelihood of this labor shortage significantly impacting market operations is high, with the potential impact rated as high due to direct effects on service delivery capabilities.

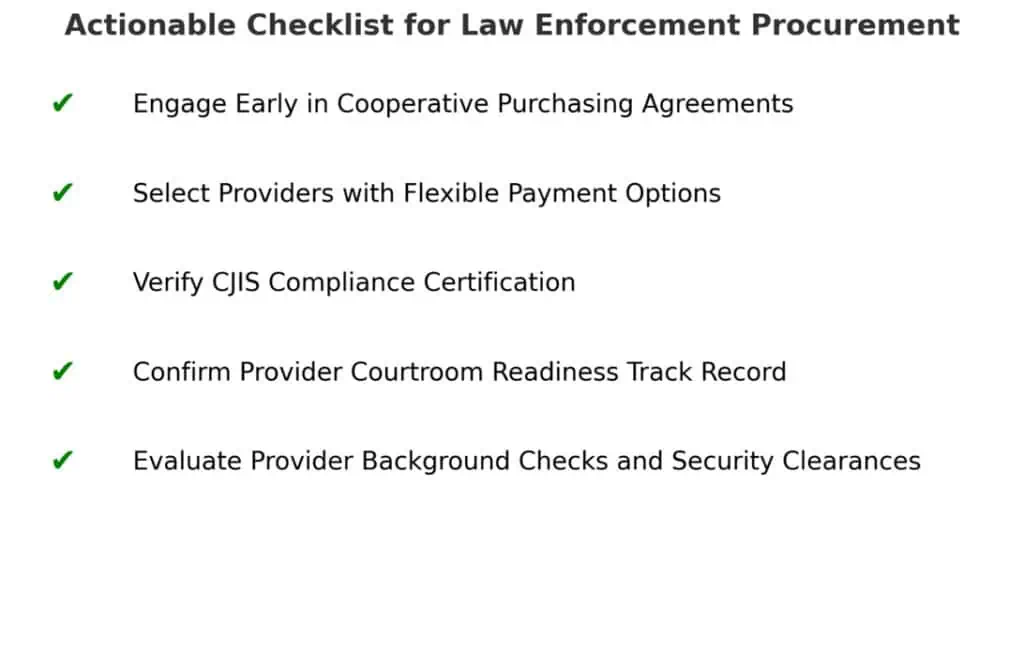

Strategic Recommendations for Law Enforcement Agencies

Law enforcement agencies can effectively manage the challenges of budget constraints and workforce limitations by adopting strategic practices in procurement and vendor partnerships. The following recommendations provide practical approaches to maximize efficiency, maintain service quality, and ensure compliance standards.

Early Adoption of Long Term Cooperative Agreements to Stabilize Costs

Agencies are advised to enter into cooperative purchasing agreements early. These agreements are competitively bid and allow multiple agencies to secure transcription services collectively at stable and predictable costs. By using such contracts, agencies can mitigate risks associated with budget fluctuations and maintain consistent access to high quality transcription services.

Partnerships with Providers Offering Flexible, Pay As You Go Models

Law enforcement agencies should prioritize partnerships with transcription service providers that offer flexible, pay as you go models. This approach allows agencies to adjust service usage based on actual needs, without long term contractual commitments or unnecessary expenses. Providers with flexible service models enable agencies to better manage unpredictable workloads and effectively allocate resources.

Prioritize Providers with Proven CJIS Compliance and Courtroom Ready Transcripts

Selecting transcription service providers with demonstrated CJIS compliance records, particularly those certified under CJIS standards, is essential. Providers must have established procedures to ensure transcripts meet court admissibility requirements and maintain confidentiality standards mandated by law. Proven providers reduce risk related to legal challenges and enhance the reliability of evidence presented in court proceedings.

Conclusion and Key Takeaways

The United States law enforcement transcription services market is forecasted to grow steadily from $375 million in 2025 to approximately $744 million by 2035. This sustained growth is primarily driven by strict regulatory compliance requirements, an increasing volume of recorded investigative data, heightened scrutiny regarding accuracy and courtroom admissibility, and rising transparency standards.

Law enforcement agencies must proactively address risks such as budget constraints and shortages of qualified transcriptionists by leveraging cooperative agreements, selecting reliable providers, and implementing flexible procurement strategies.

Next Steps for Law Enforcement Agencies

Law enforcement decision makers are encouraged to promptly review their current transcription strategies and evaluate providers based on critical criteria such as CJIS compliance, court admissibility records, and transcription accuracy. To manage operational and fiscal pressures effectively, agencies should consider engaging in cooperative purchasing agreements or adopting flexible, pay as you go service models.

Immediate consultation with a reputable transcription provider can help identify the best solutions to fulfill specific agency requirements and ensure ongoing compliance and operational effectiveness.

Ditto Transcripts is a CJIS-compliant and HIPAA-compliant, Denver, Colorado-based transcription company that provides fast, accurate, and affordable transcription services to companies and agencies of all sizes. Call (720) 287-3710 today for a free quote, and ask about our free five-day trial. Visit our website for more information about our transcription services.