Insurance companies have a lot on their plate when handling claims. Each claim is a puzzle, as it can be complicated or rife with potential slip-ups. Fortunately, innovative solutions such as insurer transcription, along with reliable legal transcription services, can help improve the insurance claim process.

By improving the flow of claims processes, insurance companies can trim down costs, boost efficiency, and make their policyholders feel like VIPs. However, doing so isn’t as simple as Thanos snapping his fingers and half of the population suddenly disappearing.

In this article, you’ll learn how:

- 76% of customers would leave an insurer after one bad experience, while 63% would pay more for excellent service, underscoring the importance of claims processing quality.

- Implementing digital tools, strategic partnerships, and internal optimization helps insurers overcome common claims challenges.

- Transcription services like Ditto support faster, more accurate claims handling, better documentation, and improved legal and compliance readiness.

Why Is Improving the Claims Process Important?

When our finances are tight, we watch our wallets like hawks. We want to ensure our money goes to businesses that care about us. And guess what? This applies to insurance, too!

According to a survey, 76% of people said they’d leave a company after one lousy experience. Conversely, 63% said they’d happily shell out more for top-notch customer service. So, insurance companies must be cautious about the claims process.

If insurance companies can treat their policyholders right during crunch time, they’ll stick with them and maybe even throw more business opportunities along the way. However, if insurers mess up even a bit, policyholders will run to the competitors faster than their insurers can say “claim denied.”

Insurance companies that continuously improve their processes can save money. Plus, by using data analytics, they can get a better read on what makes customers tick, stop losses before they happen, and keep fraud in check—it’s a win-win, so why not do it?

Common Challenges in the Claims Process

Now that we understand why it is essential for insurance companies to streamline their claims process, below are some challenges they might encounter.

- Inaccurate Information: Claims submitted with missing or incorrect details, leading to processing delays.

- Delayed Reporting of Claims: Late claim submissions hinder timely resolution and increase costs.

- Time-Consuming Paperwork: Lengthy claim forms that slow down processing and frustrate customers.

- Lack of Communication: Insufficient updates and unclear claim status are causing customer dissatisfaction.

- Inefficient Claim Allocation: Inappropriate distribution of claims to staff, leading to workload imbalances.

- Inconsistent Claims Handling Procedures: Varying approaches to claims processing that lead to inconsistencies.

- Inadequate Fraud Prevention: Insufficient measures to identify and prevent fraudulent claims that lead to financial loss.

- Difficulty in Assessing Claim Validity: Challenges in determining the legitimacy of claims due to a lack of information.

- Lack of Technological Integration: The absence of integrated systems hinders the data process.

To wrap it up, addressing these challenges requires a smarter, more connected approach to claims management. By strengthening processes, improving communication, and leveraging reliable partners such as a trial transcription service, insurers can enhance accuracy, support informed decision-making, and ensure claims are handled efficiently from start to finish.

Best Practices to Improve Claims Handling Procedures

Okay, here’s the meat and potatoes of this article. I’ve listed some effective strategies for the insurance industry to streamline its claims process, and again, this is based on my experience as a long-term policyholder.

| Focus Area | Key Actions and Benefits |

| Explore Digital Claims Solutions | Digital tools rewrite the rules of claims handling. Data analytics help managers identify patterns, detect fraud, and make confident decisions. Automated workflows route claims to the right people so nothing stalls. Mobile apps empower policyholders to submit claims and track progress with ease. Machine learning handles routine tasks, freeing claims professionals to focus on complex work and deliver a smoother, more user-friendly experience. |

| Prioritize Service Delivery | Putting customers first is nonnegotiable. Claims teams must provide clear, accurate updates to keep policyholders informed. With the right tools, staff can work smarter, reduce turnaround times, and maintain service quality. Feedback surveys and customer satisfaction metrics help insurers pinpoint gaps and continuously improve the claims experience. |

| Develop Strategic Partnerships | Partnering with specialized providers boosts efficiency and expertise. Collaborations with adjusters, repair technicians, legal professionals, court transcription services, and data analytics experts allow insurers to manage even complex claims with confidence. Technology partners bring modern claims systems that speed up processing and reduce friction for policyholders. |

| Optimize Internal Processes | Streamlined internal systems prevent information silos that slow claims handling. Integrated software platforms give claims professionals a complete view of customer data, enabling quicker and more accurate decisions. Automated task assignment ensures claims are routed based on skill and workload, reducing bottlenecks and improving cross-department coordination. |

| Enhance the Pre-Claims Experience | The pre-claims stage sets the tone for the entire journey. Self-service onboarding tools help customers complete forms correctly from the start. Proactive alerts about missing or incorrect information build trust, reduce delays, and strengthen the insurer-policyholder relationship. |

| Invest in Data Management Tools | Centralized data management platforms connect customer information from policy inception through claim resolution. This unified view supports personalized service, trend identification, and early fraud detection. Strong data control also helps insurers stay competitive while delivering proactive, high-quality customer care. |

| Offer Regular Training Opportunities | Continuous training ensures claims staff stay aligned with company policies, industry standards, and legal requirements. Performance metrics help measure training effectiveness and identify knowledge gaps. Regular updates to training materials keep teams prepared as technology, regulations, and business goals evolve. |

| Record and Transcribe Crucial Recordings | Recording key conversations with permission and converting them into transcribed documents creates a reliable reference for claims teams. Transcripts improve collaboration, accuracy, and decision-making while supporting legal compliance and risk mitigation. Outsourcing transcription eliminates the costs and complexities of in-house staffing and enables professionals like Ditto Transcripts to handle the workload efficiently. |

To tie it all together, insurers that invest in the right mix of technology, partnerships, and people position themselves for long-term success. By leveraging trusted resources such as government transcription services alongside modern claims tools and strategic providers, insurers can strengthen compliance, improve accuracy, and deliver a claims experience that is efficient, transparent, and policyholder-focused.

Why Should You Let Ditto Handle Your Transcription Needs?

Choosing Ditto Transcripts means you’ll have the market’s most affordable and accurate service provider. Using our expert services will help improve the insurance claims process.

Ditto Transcripts offers:

- Accuracy: We don’t just claim it; we guarantee 99% accuracy in every transcription project. All you have to do is focus on creating valuable recordings like customer calls, and we’ll transcribe them flawlessly.

- Human Expertise: Our team doesn’t rely on machine learning. We have experienced transcriptionists who understand the subtlety of multiple speakers, jargon, or niche terms. We’ll create transcripts that reflect the natural flow of your conversation.

- Turnaround Time: We understand your time is money, so we ensure your transcripts are delivered within the agreed-upon timeframe. You can also choose the turnaround time—a rush project or a standard one.

- Security: Recordings aren’t created equal; we understand that some may contain sensitive customer data. For that reason, Ditto Transcripts is HIPAA-, CJIS-, and FINRA-compliant. You can sleep well at night knowing that we secure the confidentiality of your content.

- Affordability: We acknowledge that recordings can be highly valuable for insurance companies and that transcribing them can be costly. That is why we offer high-quality transcription services at competitive legal transcription prices that will not break the bank. We provide flexible options to fit any budget without sacrificing accuracy or quality.

- 24/7 Customer Service: Humans run our customer service process—not chatbots. We take the time to understand your requirements and will gladly assist you with any technical details or answer any questions to ensure a smooth customer experience.

- Customizability: Our transcription services aren’t just about accuracy and meeting the client’s requirements. Do you need a verbatim transcript that captures every “um” and “uh”? Or do you need a polished version for a blog post? We can modify the transcript to meet your needs and ensure you get exactly what you need to reach your goals.

Experience the Best in the Market

Get the full potential of your audio or video content with professional business transcription services from Ditto Transcripts and engage with your insurance customers better. Gain the benefits of improved efficiency, cost-effectiveness, accessibility, and legal compliance with the highest level of accuracy.

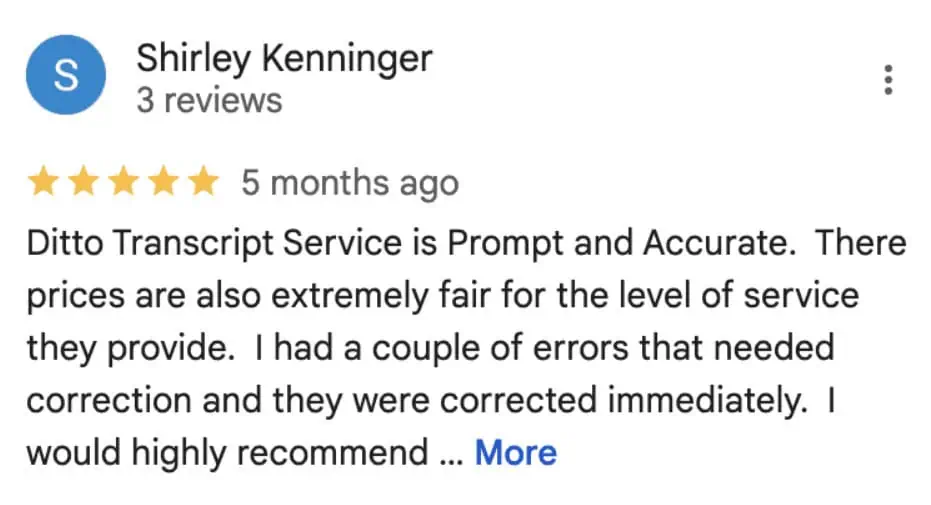

Not sure if you need transcription services, or if Ditto is the right option? Here’s a client testimonial that could be the push you need:

Ditto Transcripts is a Denver, Colorado-based FINRA, HIPAA, and CJIS-compliant transcription services company that provides fast, accurate, and affordable transcripts for individuals and companies of all sizes. Call (720) 287-3710 today for a free quote.