Processing an insurance company claim involves understanding terms embedded in legalese, which can be nearly impossible to understand, especially from the customer’s perspective. Although several solutions have emerged to make the process easier, such as legal transcription and transcription services for the insurance industry, there is still a long way to go.

In this article, you’ll learn how:

- Insurance claims work, and precise documentation is critical, especially when processing compensation for covered events such as property damage or medical emergencies.

- Additional Living Expenses (ALE) and mortgage involvement can impact how and to whom insurance payouts are distributed.

- Legal and medical transcription services streamline claims processing, ensuring that every document, statement, and report is accurate and supports fair insurance outcomes.

What are Insurance Claims?

When life throws you a curveball, like a sudden medical emergency, that’s when your insurance policy steps up. Filing an insurance claim is your way of saying, “I need a hand.” You’ll provide your insurance company with all the details, backed by evidence such as medical records, reports, and bills.

For example, imagine someone who is injured in a car accident and needs surgery. Their insurer must review hospital notes, doctor statements, and discharge summaries before deciding on the payout. That’s where accuracy becomes critical because even a small documentation error could delay or reduce the claim.

The claims adjuster then reviews everything, crunches the numbers, and determines the amount of compensation owed under the policy terms. If everything checks out, you’ll get approval and a payout. If not, you can appeal or seek legal assistance.

To keep the process smooth, it’s vital to maintain clear communication and organized documentation. That’s exactly where a medico-legal transcription service can help. It ensures every medical and legal detail is transcribed with precision, supporting both insurance companies and clients through every step of the claims process.

Common Types of Insurance

Below are some of the most common types of insurance that you might purchase in your lifetime.

| Type of Insurance | Description |

| Health Insurance | Covers medical expenses, such as doctor visits, hospital stays, prescription drugs, and preventive care. |

| Auto Insurance | Required by law in most states, auto insurance covers damages and injuries caused by car accidents. |

| Homeowners Insurance | Protects your home and personal property against losses due to events like fire, theft, and natural disasters. |

| Life Insurance | Life insurance (term life and whole life) will provide financial support to your beneficiaries in the event of your death. |

| Disability Insurance | Provides income protection if you cannot work due to an illness or injury. |

| Renters Insurance | Like homeowners’ insurance, renters insurance covers your personal property and provides liability protection for renters. |

| Umbrella Insurance | Provides additional liability coverage above and beyond the limits of your other insurance policies. |

| Long-Term Care Insurance | Helps cover the costs of extended care services, such as nursing home care or in-home care, for those with chronic illnesses or disabilities. |

| Business Insurance | Various types of insurance, such as professional liability and workers’ compensation, protect businesses from financial losses. |

| Pet Insurance | Helps cover veterinary expenses for your furry family members. |

A well-structured insurance plan safeguards your health, property, and financial stability. To further protect your legal and financial interests, court transcription services ensure every legal proceeding connected to insurance disputes or claims is accurately documented and preserved.

Things to Be Aware of When Processing Insurance Claims

Here are some key points that insurance clients need to know to understand the insurance claims process.

| Key Point | Explanation |

| Personal Property Will Initially Be Assessed Based on Cash Value | When belongings are damaged in a covered event, the insurance company calculates their cash value based on age and condition. Once you provide receipts for replacements, you may receive the difference between cash value and replacement cost. |

| Direct Payments to Contractors | A contractor might ask you to sign a “direction to pay” form, allowing the insurance company to pay them directly. Always read the fine print and consult your insurance professional before signing. |

| Expect the Possibility of Receiving More Than One Payment | You may receive multiple checks for different types of damages, such as home repairs, personal belongings, or fire losses. If your home is unlivable, an extra check may cover Additional Living Expenses (ALE). |

| Replacement Value for Items Is Contingent Upon Their Actual Replacement | For replacement value coverage, insurers first pay the cash value. To receive the rest, you must replace the items and show proof of purchase. In total losses, insurers typically pay the policy limit. |

| Your Payment May Be Managed by Your Mortgage Lender | Lenders may co-hold insurance payments and place funds in escrow until repairs are completed. Settlement distribution depends on policy terms and state laws. |

| Preliminary Payments Are Subject to Adjustment | After major damage, insurers often issue an initial payment as an advance. This can be adjusted later if more damage is found. Most policies allow about a year to file or reopen claims. |

| Checks for Additional Living Expenses (ALE) Should Be in Your Name | ALE coverage pays for temporary living costs while your home is being repaired. These checks should be issued in your name only, not your lender’s. |

In insurance-related disputes or claims, accurate documentation is vital. That’s where a dependable deposition transcription service comes in—ensuring every statement, testimony, and detail is captured with precision to support fair and well-informed resolutions.

How Transcription Can Help Insurance Companies

Recording conversations throughout the insurance claim process is a good way to understand what your customers want (as long as the recordings comply with state and federal laws). However, listening to conversations for hours on end is neither efficient nor cost-effective.

That’s why enlisting the help of professional insurance transcription services like Ditto Transcripts is your best option.

With transcripts, your insurance company can maximize data collection, improve recordings, and analyze trends from both a business and customer service perspective, further helping you achieve your goal of enabling your clients to better understand the insurance claims process.

Why Choose Ditto to Handle Your Transcription Needs?

Choosing Ditto Transcripts means you’ll have the best, most affordable, and most accurate service provider in the market.

We offer:

Accuracy

We don’t just claim it; we guarantee 99% accuracy in every transcription project. All you have to do is focus on creating valuable recordings like customer calls, and we’ll transcribe them flawlessly.

Human Expertise

Our team doesn’t rely on machine learning. We have experienced transcriptionists who understand the subtleties of multiple speakers, jargon, and niche terms. We’ll create transcripts that reflect the natural flow of your conversation.

Turnaround Time

We understand your time is money, so we ensure your transcripts are delivered on time. You can also choose the turnaround time—a rush project or a standard one.

Security

Recordings aren’t created equal; we understand that some may contain sensitive customer data. For that reason, Ditto Transcripts is HIPAA-, CJIS-, and FINRA-compliant. You can sleep well at night knowing that we secure the confidentiality of your content.

Affordability

We acknowledge that recordings can be highly valuable for insurance companies, and that transcribing them can be a costly process. We offer high-quality transcription services that won’t break the bank—we have options to fit any budget without compromising quality. You can check out our legal transcription prices to know more.

24/7 Customer Service

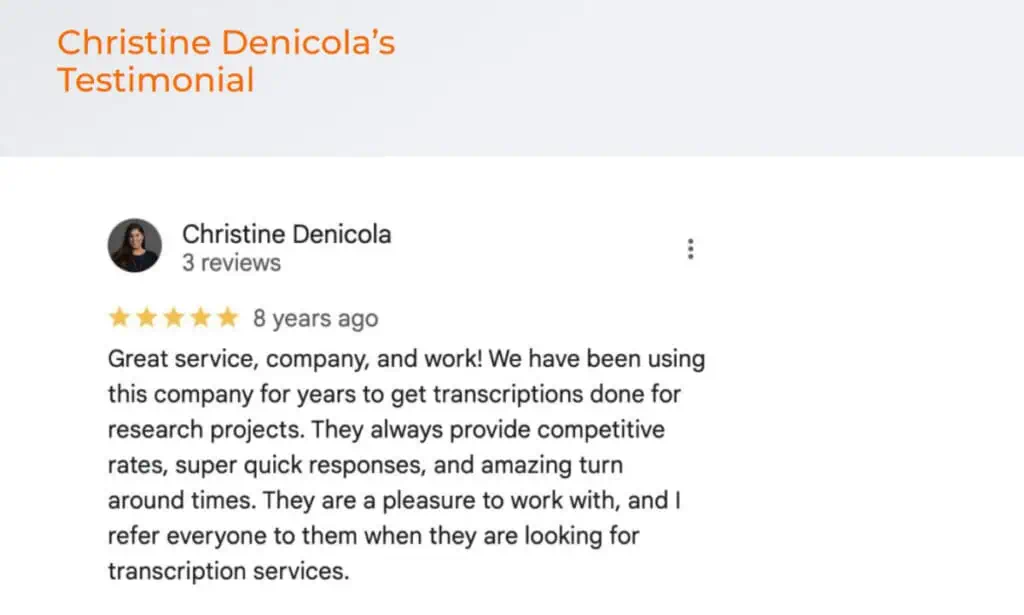

Humans run our customer service process—not chatbots. We take the time to understand your requirements and will gladly assist you with any technical details or answer any questions to ensure a smooth customer experience. Interested in what our customers say? Here’s one of their testimonials:

Customizability

Our transcription services aren’t just about accuracy and meeting the client’s requirements. Do you need a verbatim transcript that captures every “um” and “uh”? Or do you need a polished version for a blog post? We can modify the transcript to meet your specific needs and ensure you receive exactly what you need to achieve your goals.

Ditto Transcripts is a Denver, Colorado-based FINRA, HIPAA, and CJIS-compliant transcription services company that provides fast, accurate, and affordable transcripts for individuals and companies of all sizes. Call (720) 287-3710 today for a free quote.