Engaging with customers helps insurance companies offer exceptional experiences by providing solutions that align with the customers’ preferences, pain points, and needs. One of the most effective ways to enhance customer engagement in this modern era is by utilizing insurance transcription services alongside reliable legal transcription services.

In this article, you’ll learn how:

- Transcription pricing can be based on lines, pages, audio minutes, or flat fees—understanding these methods helps avoid hidden costs and ensures fair billing.

- Factors such as poor audio quality, multiple speakers, or quick turnaround requests can significantly affect your final bill.

- Choosing a reputable transcription company like Ditto Transcripts guarantees transparent pricing, 99.9% accuracy, and legally compliant, U.S.-based services.

Practical Tips For Positive Insurance Customer Engagement

Let’s first discuss tips insurance companies can use to maintain positive customer engagement.

| Strategy | Description |

| Improve Your Website | Many insurance companies struggle to keep up with modern digital expectations. A well-designed website improves engagement and helps customers research insurance products before purchasing. Clear layouts, educational content, glossaries, FAQs, comparison articles, and helpful blog posts ensure clients find the information they need without having to search elsewhere. |

| Streamline Navigation | Make it easy for clients to find information with clear menus, a logical site structure, and search functionality. |

| Personalize the Experience | Use client data to tailor content, offers, and recommendations based on individual needs. |

| Offer Self-Service Options | Allow clients to manage policies, file claims, and get answers to common questions anytime through the website. |

| Optimize for Mobile | Ensure the website is fully responsive so clients can easily access it on smartphones and tablets. |

| Integrate Live Chat | Provide real-time support to answer questions and assist potential clients quickly. |

| Request Feedback | Gather client input through surveys, reviews, and user testing to continuously improve the website experience. |

| Help Customers Get the Best Deals | Engage clients by offering personalized savings recommendations, not just listing discounts. Suggestions like installing home security systems or making lifestyle changes can help lower premiums and add value. |

| Get the Most Out of Your Business Phone | Since many clients prefer calling before purchasing, custom on-hold messages can educate callers about products, discounts, claims processes, and additional services while they wait. |

| Hold Client Relationships in High Regard | Trust and retention come from prioritizing relationships, not just pricing. Align communication methods with client preferences, such as phone, email, or in-person, to show genuine care. |

| Look Forward to Questions | Encourage questions and proactively address “what if” scenarios. Using hypothetical examples reassures clients that advisors are prepared for unexpected situations. |

| Always Show Gratitude | A sincere thank you reinforces trust and appreciation. Going beyond standard benefits strengthens long-term client relationships. |

| Put a Yearly Insurance Check on the Calendar | Annual reviews help address changes in a client’s life, explain premium factors, and educate clients. These meetings should focus on listening and guidance rather than selling. |

| Capture and Transcribe Important Talks | Insurance conversations often include complex details. Recording these interactions for a transcript, when permitted, promotes transparency, helps clients review information at their own pace, reduces misunderstandings, and provides documentation for future reference. |

Together, these strategies help insurance companies strengthen client relationships, improve communication, and build long-term trust. From enhancing digital experiences to recording these interactions for a transcript, reliable transcription solutions, including government transcription services, play an essential role in maintaining accuracy, transparency, and compliance across client communications.

More Useful Tips for Insurers When Dealing with Clients

In addition to the strategies I’ve mentioned, here are some other ways insurers can maintain or create positive engagement with their clients.

- Listen actively

- Be transparent

- Offer personalized solutions

- Follow up regularly

- Provide multi-channel communication

- Be proactive with policy reviews

- Respond promptly

- Build rapport

- Offer value-added services

- Use clear language

- Show empathy

- Stay professional and friendly

- Continuously educate yourself

- Act on client feedback

- Advocate for clients

- Celebrate milestones

- Be flexible and convenient

- Use technology

- Prioritize clients’ interests

In addition to these strategies, maintaining positive client engagement requires a consistent commitment to clear communication, empathy, and responsiveness.

By actively listening, offering personalized solutions, and leveraging technology such as deposition transcription services, insurers can ensure accurate documentation, improved transparency, and stronger client trust throughout every interaction.

Why Choose Ditto to Handle Your Transcription Needs?

Choosing Ditto Transcripts means you’ll have the best, most affordable, and most accurate service provider in the market, improving your insurance company’s ability to engage customers.

Ditto Transcripts offers:

- Accuracy: We don’t just claim it; we guarantee 99% accuracy in every transcription project. All you have to do is focus on creating valuable recordings, like customer calls, and we’ll handle the rest, whether it’s standard business audio or specialized needs like court transcription services.

- Human Expertise: Our team doesn’t rely on machine learning. We have experienced transcriptionists who understand the subtleties of multiple speakers, jargon, and niche terms. We’ll create transcripts that reflect the natural flow of your conversation.

- Turnaround Time: We understand your time is money, so we ensure your transcripts are delivered within the agreed-upon timeframe. You can also choose the turnaround time.

- Security: Recordings aren’t created equal; we understand that some may contain sensitive customer data. For that reason, Ditto Transcripts is HIPAA-, CJIS-, and FINRA-compliant. You can sleep well at night knowing that we secure the confidentiality of your content.

- Affordability: We acknowledge that recordings can be highly valuable for insurance companies and that transcribing them can be costly. So, we offer high-quality services with legal transcription prices that won’t break the bank, with options to fit any budget without sacrificing quality.

- 24/7 Customer Service: Humans run our customer service process—not chatbots. We take the time to understand your requirements and will gladly assist you with any technical details or answer any questions to ensure an excellent customer experience.

- Customizability: Our transcription services aren’t just about accuracy and meeting the client’s requirements. Do you need a verbatim transcript that captures every “um” and “uh”? Or do you need a polished version for a blog post? We can modify the transcript to meet your needs and ensure you get exactly what you need to reach your goals.

Experience Our Services

Get the full potential of your audio or video content with professional business transcription services from Ditto Transcripts and engage with your insurance customers better. Gain the benefits of improved efficiency, cost-effectiveness, accessibility, and legal compliance with the highest level of accuracy.

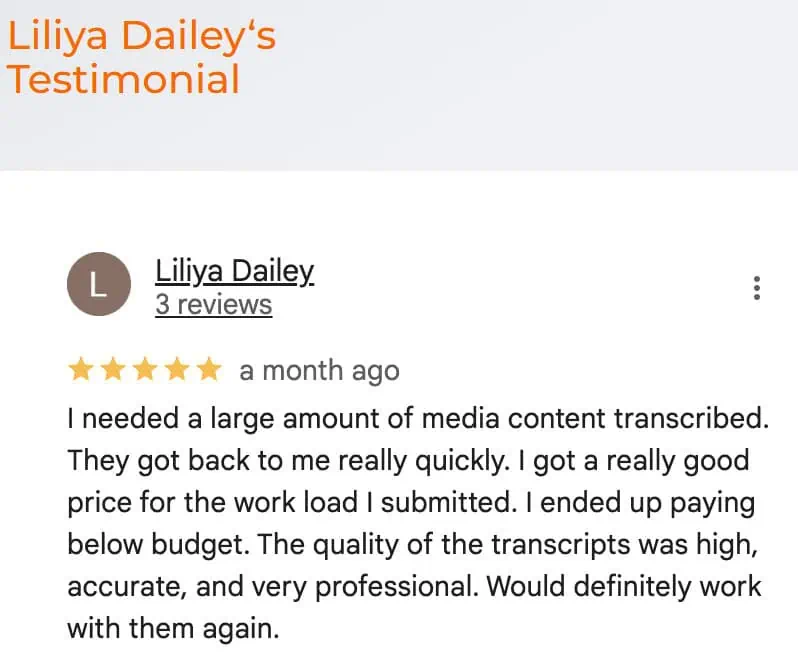

Not convinced yet? Maybe testimonials can be the push you need.

Ditto Transcripts is a Denver, Colorado-based FINRA, HIPAA, and CJIS-compliant transcription services company that provides fast, accurate, and affordable transcripts for individuals and companies of all sizes. Call (720) 287-3710 today for a free quote.